Published on: Jan 3, 2024

Third-Party Risk Management: What Is It?

Third-party risk management plays a pivotal role in safeguarding businesses from external threats.

In this in-depth guide, we'll discuss the core aspects of TPRM, highlighting the distinctions between third and fourth parties, the various risks they might bring, and the best practices you should follow.

We'll also talk about the benefits of dedicated TPRM software and its role in strengthening an organization's defence mechanisms.

Let's begin!

What Is a Third Party?

A third party in cybersecurity refers to an external entity or organization that is not directly involved in a particular transaction or system but can still impact its security.

Third parties often provide services, software, or components that organizations rely on to operate efficiently. These external entities can include vendors, suppliers, contractors, or any external party with whom an organization shares data or access to its systems.

What is a Fourth Party?

A fourth party refers to an entity or organization that indirectly interacts with your network or data systems, often through intermediaries or third-party connections. Unlike a third party, which has a direct relationship with your organization, fourth parties are further removed but can still present significant security risks.

How is a fourth party Related to a Third-Party?

The relationship between fourth parties and third parties is hierarchical. Third parties directly engage with your organization, providing services or accessing your data. Fourth parties, on the other hand, are entities that have relationships with your third-party partners.

In essence, they are your third-party's third party. The actions of fourth parties can indirectly impact your cybersecurity posture and approach.

Why is it Important to Know About Fourth Parties?

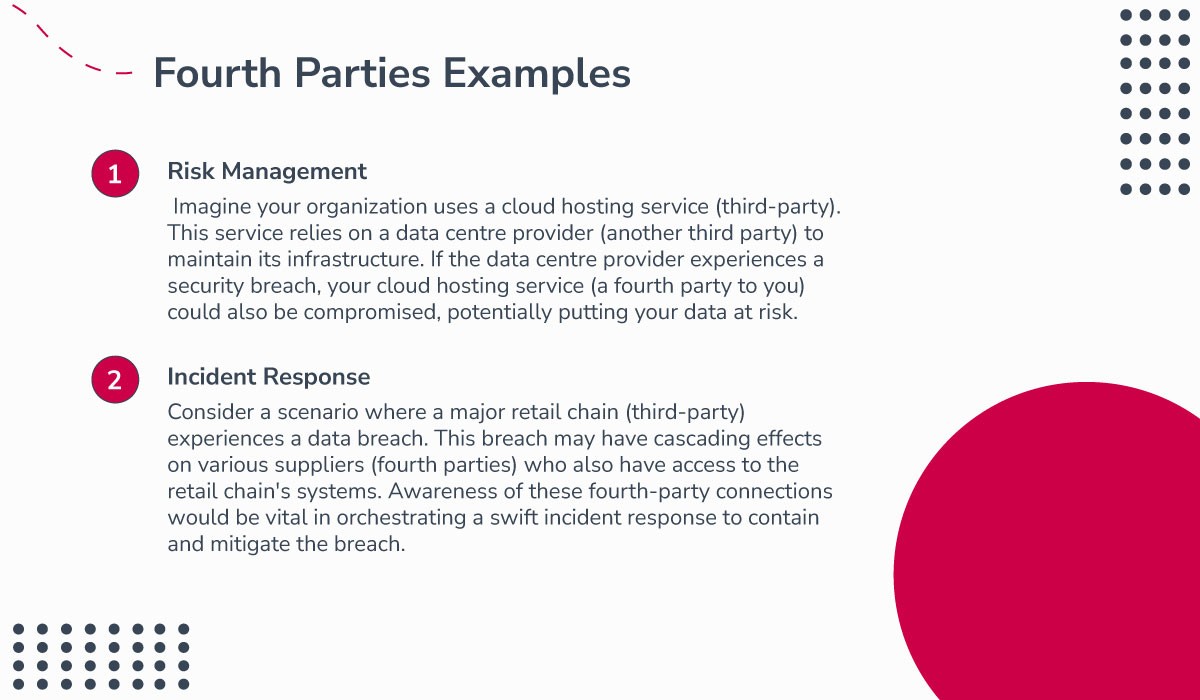

Understanding fourth-party relationships is crucial for several reasons. Here are some examples to illustrate their significance:

Risk Management: Imagine your organization uses a cloud hosting service (third-party). This service relies on a data centre provider (another third party) to maintain its infrastructure. If the data centre provider experiences a security breach, your cloud hosting service (a fourth party to you) could also be compromised, potentially putting your data at risk.

Compliance: Suppose you're a healthcare provider outsourcing medical billing to a third-party company. That third party, in turn, relies on a software vendor for their billing platform (a fourth party to you). Compliance with healthcare regulations extends not just to your direct relationship with the billing company, but also to their interactions with the software vendor.

Incident Response: Consider a scenario where a major retail chain (third-party) experiences a data breach. This breach may have cascading effects on various suppliers (fourth parties) who also have access to the retail chain's systems. Awareness of these fourth-party connections would be vital in orchestrating a swift incident response to contain and mitigate the breach.

Risk Mitigation: If your organization uses a third-party IT security consultancy, it's essential to inquire about their subcontractors or partners (fourth parties) involved in your security assessments. Understanding their role and cybersecurity measures ensures that your organization's vulnerabilities are not inadvertently exposed through these relationships.

Vendor Assessment: When assessing the cybersecurity practices of a third-party logistics provider, it's imperative to extend your scrutiny to the transportation companies they engage (fourth parties). These transportation partners can have access to your sensitive shipments and data during transit.

Industries such as healthcare, banking, and federal contracting are heavily influenced by regulatory standards that shape Third-Party Risk Management (TPRM) programs. These industries must adhere to comprehensive regulatory frameworks due to the sensitive data they handle, driving the need for robust TPRM processes.

Regulatory Frameworks and Compliance:

For example, the Payment Card Industry Data Security Standard (PCI-DSS) is a critical regulatory framework that impacts TPRM. It mandates that companies not only secure their own cybersecurity programs but also ensure their third-party providers do not compromise cardholder data security. This highlights the intricate web of compliance that extends to fourth parties in your supply chain.

Federal Contracting Requirements:

In federal contracting, strict security measures are compulsory for all vendors with access to sensitive information. The process requires more than just documentation; it involves thorough checks like scanning internal environments and obtaining legal assurances from executives about data protection measures.

The intricate complexities and potential conflicts in these regulated industries drive companies to continuously enhance their risk management and mitigation strategies. By understanding and managing both third and fourth-party relationships, organizations can better navigate the compliance landscape and protect their data integrity.

Now, let's talk about what you came for!

What is Third-Party Risk Management?

Third-Party Risk Management (TPRM) is a vital aspect of corporate governance and cybersecurity. It involves the assessment, monitoring, and mitigation of risks associated with the engagement of external parties, such as vendors, suppliers, contractors, or service providers, who have access to a company's data, systems, or operations.

In today's complex landscape, ongoing geopolitical crises, catastrophic climate events, unexpected supply chain disruptions, and increasing third-party cybersecurity threats have necessitated the rapid implementation of robust TPRM programs. Organizations are leveraging these programs to manage the risks posed by third parties effectively.

In essence, TPRM seeks to ensure that these third parties do not pose a threat to the organization's security, compliance, reputation, or operational continuity. It encompasses various processes, including due diligence, risk assessment, contractual agreements, ongoing monitoring, and response planning.

How Service Level Agreements and Backup Vendors Support Third-Party Risk Management

To effectively reduce the operational risks posed by third parties, organizations rely on two strategic tools: service level agreements (SLAs) and backup vendors.

SLAs clearly set expectations around a vendor’s performance, data handling, security protocols, and response times. By outlining these requirements, both parties understand what’s at stake if an incident occurs. This documented agreement helps ensure that external partners remain aligned with your company’s standards and tolerances for risk.

Equally important, establishing relationships with backup vendors—think of it as having a spare tire for your supply chain—helps organizations remain resilient if their primary partner experiences downtime or fails to deliver as promised. For example, if a logistics provider like FedEx faces a disruption, having agreements in place with alternatives such as UPS or DHL allows continued operations with minimal impact.

Together, these measures reinforce business continuity while enabling organizations to maintain control when unforeseen challenges arise from their third-party ecosystem.

Key Functions of TPRM

Managing Cybersecurity Risks: Most TPRM executives focus on managing cybersecurity threats, ensuring that third parties adhere to security protocols to protect sensitive data and systems.

Enabling Data Governance: By implementing TPRM, organizations can streamline their data governance efforts, ensuring that third parties comply with data handling and privacy standards.

Improving Cost Efficiency: TPRM programs are designed to optimize resource allocation, minimizing unnecessary expenditures while maintaining high standards of security and compliance.

Keep in mind the following:

While Third-Party Risk Management and Vendor Risk Management (VRM) are closely related concepts, they are not entirely interchangeable.

Vendor Risk Management (VRM) is a subset of Third-Party Risk Management. VRM specifically focuses on evaluating and managing the risks associated with vendors and suppliers who provide goods and services to an organization. This often includes assessing financial stability, product quality, delivery performance, and compliance with contractual terms.

Third-Party Risk Management (TPRM) takes a broader perspective, encompassing all external parties, including vendors but also extending to contractors, service providers, and any other entities that interact with the organization. TPRM addresses not only the operational and financial aspects but also information security, data privacy, regulatory compliance, and reputational risks.

By integrating these functions, TPRM strengthens an organization's resilience against both anticipated and unexpected threats, ensuring a more secure and efficient operational environment.

Regulatory and Compliance Requirements Driving TPRM

A comprehensive TPRM program is often shaped by various regulatory and compliance requirements. These regulations provide a framework for managing third-party risk effectively. Key regulations and guidelines include:

CMMC, EBA, FCA, FFIEC, HIPAA, NERC, NIST, NYDFS, OCC: These are specific to different sectors and dictate standards for data security and vendor management.

GDPR and CCPA: These focus on data privacy and protection, especially concerning customer data, influencing how organizations manage third-party relationships.

Factors Influencing Regulatory Requirements

Organization Type and Location: Regulations may vary depending on whether your organization is a financial institution, healthcare provider, or another type of entity.

Customer Location: Knowing where your customers reside is crucial as it determines the data protection laws applicable to your operations.

Understanding these requirements ensures your TPRM program accounts for the data your organization must protect and establishes the standards your vendors must meet. These requirements are essential to include in agreements with vendors handling sensitive or regulated data.

To sum up!

While Third-Party Risk Management and Vendor Risk Management share common elements, they serve different purposes within the overall risk management framework of an organization. TPRM covers a wider range of external relationships, making it a more comprehensive approach to mitigating risks associated with third parties.

Rolling Out a Modern TPRM Program: The Continuous Approach

So, what does it actually look like to run a Third-Party Risk Management program in today’s landscape? Gone are the days of one-and-done vendor reviews. Instead, a well-executed TPRM program hinges on a dynamic, ongoing process. Especially when you weave in continuous monitoring.

Here’s how organizations bring it all together:

1. Set Up a Defined Assessment Process: Before anything else, establish a clear vendor risk assessment framework. This forms the backbone of your program, outlining how you’ll examine vendors right from the start. Think GDPR for data privacy, NIST for security, or sector-specific regulations like HIPAA.

2. Engage Your Vendors: Initiate regular communication with your third parties. Share expectations, clarify requirements, and make sure everyone is on the same page. This is where due diligence and relationship-building intersect.

3. Integrate Continuous Monitoring Tools: Once your foundation is in place, shift from episodic check-ins to continuous oversight. Automated tools, often powered by data analytics, keep tabs on your vendors’ risk profiles in real time, monitoring everything from patching and malware scans to the validity of SSL certifications.

4. Spot and Address Issues Proactively: Continuous monitoring means you no longer wait for an annual review to uncover risk. Instead, real-time alerts flag changes or anomalies, so your team can investigate and respond before minor hiccups become full-blown crises.

5. Save Resources and Improve Accuracy: By relying less on sprawling manual questionnaires and more on objective, data-driven insights, organizations streamline the process and minimize human error. This lets teams focus on high-impact risks, instead of wading through endless paperwork.

6. Iterate and Improve: Use findings from ongoing monitoring to refine your policies and procedures, ensuring your TPRM program evolves alongside your third-party ecosystem.

Ultimately, continuous monitoring transforms TPRM from a rigid, calendar-driven formality into an agile, intelligence-driven discipline, helping organizations stay ahead of threats and maintain confidence in every third-party relationship.

How to Define Organizational Goals for Third-Party Risk Management

Establishing clear and actionable goals lays the foundation for an effective TPRM program. But where should organizations begin?

Start by aligning your third-party risk objectives with your broader enterprise risk management strategy. This means taking stock of all external partners—vendors, contractors, service providers—and distinguishing their roles, the data they access, and their potential impact on your operations.

To get a holistic view, create a comprehensive inventory of your third-party relationships. This inventory should consider a range of risk categories, such as:

Geopolitical risks (think global suppliers or shifting regulations)

Financial and reputational risks

Operational, strategic, and business continuity risks

Cybersecurity and resiliency risks

By mapping these out, you equip your organization to spot high-priority risks and determine your risk appetite (how much risk you're willing (or able) to tolerate).

Additionally, embed your TPRM goals within your existing risk management framework. This ensures that those responsible for managing external partners have clear guidelines and know exactly how to monitor, evaluate, and act on risk-related issues.

When you take the time to define these goals up front, you'll not only strengthen your policy’s impact, but also improve communication, accountability, and responsiveness throughout your third-party ecosystem.

The Evolution of Third-Party Risk Management (TPRM)

From Annual Checklists to Daily Essentials

Third-Party Risk Management (TPRM) has transformed remarkably over the years. Originally seen as a once-a-year task, it’s now an indispensable part of daily operations for businesses around the globe. This evolution reflects the increasing complexity and interconnectedness among companies, vendors, and global partners.

The Shift from Emails to Automation

Years ago, TPRM activities largely revolved around exchanging emails—an approach that was not only cumbersome but also lacked depth. Fast-forward to today, and TPRM has embraced advanced methodologies. Current practices involve continuous monitoring techniques that leverage automation, enabling businesses to react swiftly to potential threats.

Integration with Technology and Collaboration

Modern TPRM combines traditional due diligence with cutting-edge technology. This means integrating data analytics, real-time insights, and automated alerts, which result in a more proactive risk management strategy. By incorporating these tools, businesses can better anticipate disruptions caused by incidents anywhere in the world.

Adapting to a Globalized Business Environment

In an era where a distant disruption can instantly impact client services, TPRM's role has become more critical than ever. It now entails a comprehensive understanding and real-time management of risks—highlighting just how vital these evolved practices are in maintaining operational resilience and stability.

Key Considerations for Establishing a TPRM Program: Internal and External Stakeholders

Involving Internal Stakeholders

When setting up a Third-Party Risk Management (TPRM) program, comprehensively involving your internal stakeholders is crucial. This ensures alignment across the board, setting the foundation for a robust and effective program. The internal audience typically includes:

Leadership Team: Key decision-makers like the CEO, CFO, CIO, COO, and CISO play an essential role in resource allocation and strategic direction.

Legal and Compliance: General Counsel ensures the program aligns with legal requirements and mitigates potential legal risks.

Board Members: Provide oversight and strategic input that bolster the program's credibility and effectiveness.

Internal Auditors: Offer insights into financial and operational risks, ensuring processes are adhered to.

Depending on the scope and nature of your operations, other internal parties may also be vital. Evaluate based on your organization’s specific needs.

Engaging External Stakeholders

External stakeholders are equally significant in crafting a TPRM program. They not only influence but also help in fine-tuning the program. These include:

Vendors: Critical partners whose compliance and security posture directly affect your own risk management.

Regulators: Their expectations and guidelines must be heeded to meet industry standards and regulatory compliance.

Customers: They demand transparency and assurance, which are reflected in a robust TPRM program.

Why Stakeholder Buy-In Matters—and How to Achieve It

Securing genuine buy-in from stakeholders is the linchpin of any successful TPRM program. When key players recognize the value of third-party risk management and actively participate, the program becomes far more effective and resilient.

Why is this so crucial? Without broad support, even the best-designed TPRM initiatives can falter, processes may be ignored, critical gaps overlooked, and risk left unmanaged. Aligning everyone from procurement and compliance to IT and commercial teams ensures that potential threats are identified and addressed from multiple angles, not simply shuffled off as someone else’s problem.

How do you get there? Start by involving stakeholders early in the process. Invite them to co-develop policies and workflows, and make space for open dialogue about pain points and priorities. Encourage regular communication between departments, think workshops or collaborative planning sessions so that risk management isn’t just a compliance box to check, but a shared responsibility.

Most importantly, demonstrate how effective TPRM not only fulfills regulatory requirements but also supports broader business goals like operational continuity, customer trust, and brand reputation. When stakeholders see the program’s real-world impact, buy-in becomes far easier to achieve and sustain.

Assess Existing Agreements

Another key aspect is the evaluation of current agreements and relationships with third parties. Analyze these meticulously against your proposed TPRM program to identify any discrepancies. Be proactive in documenting these gaps and strategizing on mitigating uncovered risks, following up diligently until resolutions are achieved.

In summary, creating a successful TPRM program requires a balanced approach involving both internal and external players, coupled with a keen eye on current contracts. Tailor this framework to suit your organization’s unique ecosystem for optimal results.

Fostering Collaboration Across Business Units for Effective Third-Party Oversight

For a TPRM program to deliver real value, active collaboration between business units is essential. By working together, departments can bring unique perspectives and expertise to the table—creating a more holistic and accurate picture of third-party risk.

Here’s how business units can partner to identify, track, and assess third-party vendors:

Shared Identification: Encourage sourcing, procurement, IT, legal, and business teams to maintain a centralized vendor inventory. By pooling information from all corners of the organization, you’re less likely to overlook hidden or shadow vendors.

Joint Tracking Efforts: Build a cross-functional review process to monitor vendor relationships over time. This allows for more frequent detection of emerging risks, changes in vendor performance, or shifts in the regulatory landscape that may impact ongoing contracts.

Collaborative Assessment: Combine subject matter expertise—such as IT’s insight into cybersecurity controls and finance’s evaluation of a vendor’s stability—to create richer, more informed risk assessments. Use a mix of qualitative judgment and quantitative data (for example, scoring models or dashboards) to evaluate and compare vendors.

Continuous Communication: Establish regular touchpoints between units for reporting incidents or performance concerns, sharing the results of periodic reviews, and adapting assessment approaches based on lessons learned.

Once you've established a collaborative process and pooled expertise across your business units, the next critical phase is tackling the practical steps of third-party evaluation and onboarding. Here’s how organizations can thoughtfully remediate risks and make well-informed decisions regarding third-party vendors:

Thorough Risk Assessment: Begin by scrutinizing each prospective vendor’s risk profile, drawing on resources like BitSight or SecurityScorecard to gauge their security posture before entering any agreements. This analysis should weigh factors such as data handling practices, regulatory compliance, and historical incident response.

Engage for Transparency: Move beyond external audits by requesting detailed information about the vendor’s internal controls and security programs, routine questionnaires, SOC reports, or even onsite assessments can provide crucial clarity that’s otherwise unavailable from the outside.

Collaborative Problem Solving: If gaps or red flags appear, open a dialogue with the vendor to discuss specific risk areas. Together, outline concrete remediation steps with clear deadlines, using centralized project management or remediation tracking tools to keep progress visible and on schedule.

Decision-Making Framework: Decisions to move forward should reflect your organization’s risk appetite, the vendor’s remediation track record, and the criticality of their services. Document this decision-making trail for accountability, sometimes, saying “no” or seeking alternative vendors is the safest path.

Ongoing Vigilance: Onboarding is only the start. Set up regular monitoring protocols with continuous review via security ratings, compliance checks, and performance dashboards, ensuring that vendors uphold commitments long after the ink is dry.

By embedding these practices into your onboarding playbook, you’ll empower your organization to address risks early, enable informed, strategic partnerships, and keep your third-party ecosystem resilient as it evolves.

How Can Third-Party Risk Management Help Your Company

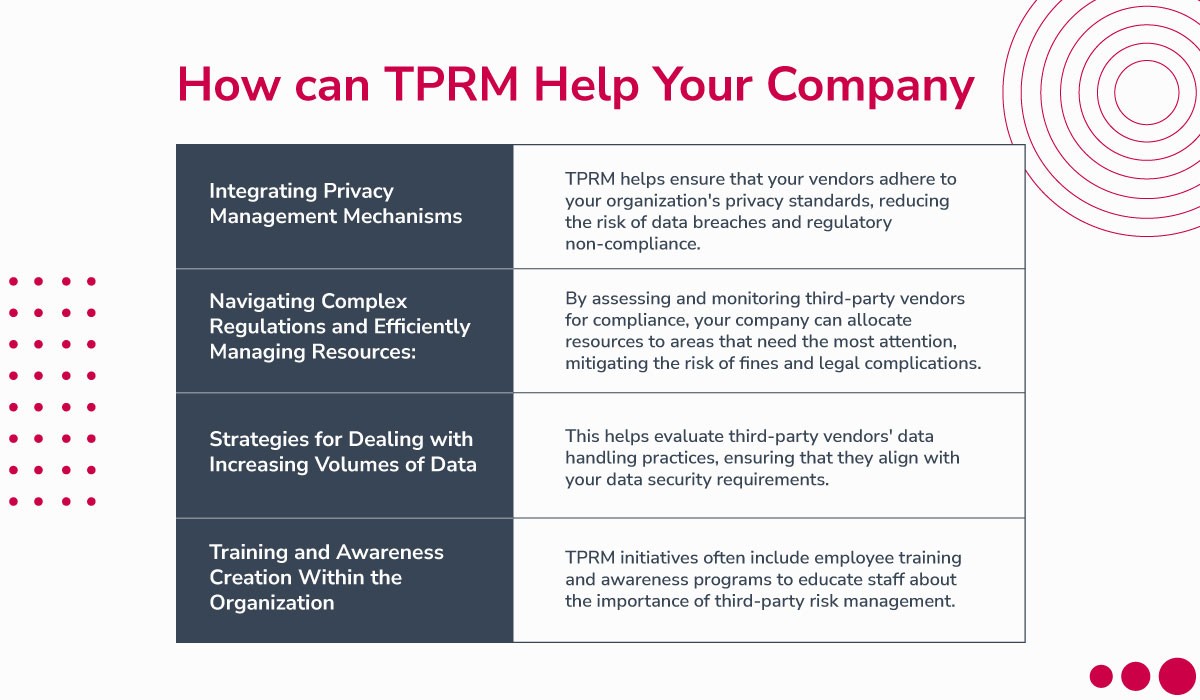

Third-Party Risk Management (TPRM) plays a crucial role in enhancing your company's overall security and compliance. Here's a comprehensive and concise overview of how TPRM can benefit your organization in four key areas:

1. Integrating Privacy Management Mechanisms: TPRM assists your company in addressing the challenges of incorporating robust privacy management mechanisms. With the growing importance of data privacy regulations like GDPR and CCPA, third-party vendors often handle sensitive customer data. TPRM helps ensure that these vendors adhere to your organization's privacy standards, reducing the risk of data breaches and regulatory non-compliance.

2. Navigating Complex Regulations and Efficiently Managing Resources: Keeping up with evolving and intricate regulations can be daunting. TPRM provides a structured framework for understanding and complying with these regulations. By assessing and monitoring third-party vendors for compliance, your company can efficiently allocate resources to areas that need the most attention, mitigating the risk of costly fines and legal complications.

3. Strategies for Dealing with Increasing Volumes of Data: As businesses generate and handle vast amounts of data, TPRM offers strategies to manage the associated risks. It helps evaluate third-party vendors' data handling practices, ensuring that they align with your data security requirements. This proactive approach helps protect sensitive information and maintain data integrity as the volume of data continues to grow.

4. Training and Awareness Creation Within the Organization: TPRM extends beyond vendor assessment; it involves creating a culture of security and compliance within your organization. TPRM initiatives often include employee training and awareness programs to educate staff about the importance of third-party risk management. This helps foster a security-conscious workforce that can actively contribute to risk mitigation efforts.

In a nutshell:

Third-Party Risk Management assists your company in integrating privacy management mechanisms, navigating complex regulations, efficiently managing resources, and addressing the challenges posed by increasing volumes of data. Additionally, it fosters a culture of awareness and preparedness within your organization to mitigate third-party-related risks effectively.

What Questions Should You Ask to Determine a Vendor's Risk Level or Priority Tier?

To properly categorize vendors according to their risk level or priority tier, it's crucial to ask targeted questions that consider both their access to critical assets and the impact of potential failures. Here are key questions to guide your evaluation:

Will the vendor have access to sensitive business data or regulated information?

For example, could they view or process confidential financial records, intellectual property, or customer data governed by GDPR, HIPAA, or similar standards?Does the vendor perform an essential function for your core operations?

Would your ability to serve customers or comply with regulations be compromised if the vendor experiences downtime or fails to deliver?What is the potential fallout if proprietary information entrusted to this vendor is inadvertently disclosed, deleted, or altered?

Think through scenarios like unauthorized access, accidental erasure or manipulation, or ransomware locking access to critical data.How easily can operations recover if this vendor fails?

Would a disruption force your team to activate disaster recovery plans, or could business continue with minimal interruption?Does the vendor's security posture align with your organization's risk appetite and regulatory obligations?

Are there adequate controls in place for data protection, and do they routinely undergo security audits such as SOC 2 or ISO 27001?

By addressing these questions, you gain a clearer view of which vendors pose the most significant risks—and which should be prioritized for ongoing monitoring and due diligence. This structured approach is key to building a resilient third-party risk management program that supports both business continuity and regulatory compliance.

Why Vendor Risk Levels and Management Approaches Differ

Not all third-party vendors are created equal when it comes to risk. The degree of risk a vendor introduces hinges primarily on what they access and how integral their role is to your business.

For instance, a company like Staples, which supplies your office stationery, generally doesn’t need access to your internal systems, customer data, or proprietary information. In contrast, working with Salesforce as your CRM or Stripe for payment processing means granting them significant access to sensitive business data and critical workflows. Any misstep or security lapse on their end could have direct financial, operational, or reputational consequences for your organization.

The greater the access a third party has to your IT environment, confidential data, or essential operations, the more robust your risk management approach needs to be. While low-risk vendors may simply require basic screening, high-risk partners (those handling financial transactions, personal data, or integral infrastructure) should be subject to more rigorous due diligence, monitoring, and contractual controls.

Understanding these distinctions allows you to focus resources and oversight where they’re needed most, ensuring your risk management efforts are both efficient and effective.

Why You Should Invest in Third-Party Risk Management

Investing in Third-Party Risk Management (TPRM) is a strategic decision that offers numerous benefits to organizations in various industries. Here are some compelling reasons why you should consider investing in TPRM:

1. Cost Reduction: TPRM can lead to significant cost savings by helping organizations identify and mitigate risks associated with their third-party vendors. Proactively addressing potential issues, like data breaches or operational disruptions, organizations can avoid costly incidents and legal liabilities.

2. Security: TPRM enhances cybersecurity by ensuring that third-party vendors meet security standards and adhere to data protection regulations. This safeguards sensitive information and reduces the risk of data breaches, which can be devastating for both a company's reputation and its bottom line.

3. Compliance: Regulatory compliance is a critical aspect of modern business operations. TPRM assists organizations in ensuring that their third-party vendors comply with industry-specific regulations and standards. This not only helps avoid fines and penalties but also fosters trust among stakeholders.

4. Risk Reduction: TPRM enables organizations to proactively identify and mitigate risks associated with third-party relationships. Comprehensive risk assessments and ongoing vendor performance monitoring minimize the chances of disruptions and financial setbacks.

5. Confidence: Implementing TPRM instills confidence in stakeholders, including customers, investors, and partners. Knowing that a company has robust third-party risk management practices in place can enhance trust and credibility in the market.

6. Peace of Mind: TPRM provides peace of mind to senior management and boards of directors by offering visibility into the risks posed by third-party relationships. This transparency allows for informed decision-making and ensures that potential risks are managed effectively.

To wrap things up:

Investing in Third-Party Risk Management is imperative for organizations looking to protect their reputation, reduce costs, enhance security, ensure compliance, and build confidence among stakeholders. It is a proactive approach that not only mitigates risks but also contributes to long-term business resilience and success.

Key Takeaways

Third-party risk management is vital for businesses to protect against external threats in our interconnected world.

While third parties directly interact with an organization, fourth parties are a step removed but can still pose significant security risks.

Risks introduced by third parties can range from cybersecurity threats and operational disruptions to reputational damage and legal complications.

TPRM is more than just vendor risk management. Third-party risk management covers a wide range of external relationships, offering a comprehensive approach to risk management.